A Tool Born from Industry Collaboration Back in 2017, I developed the Insurance Gap Protection Calculator following a request by the Malaysian Takaful Association (MTA) and the Life Insurance Association of Malaysia (LIAM), under the guidance of Bank Negara Malaysia (BNM). The goal was clear—create a simple, reliable, and accessible tool that could help everyday Malaysians understand how much life insurance or takaful protection they truly need.

Many people struggle to gauge whether their coverage is sufficient, and even fewer know how to calculate what they can realistically afford. This calculator aimed to change that by combining clarity, simplicity, and precision—all wrapped in an intuitive web interface.

Making Financial Awareness Accessible

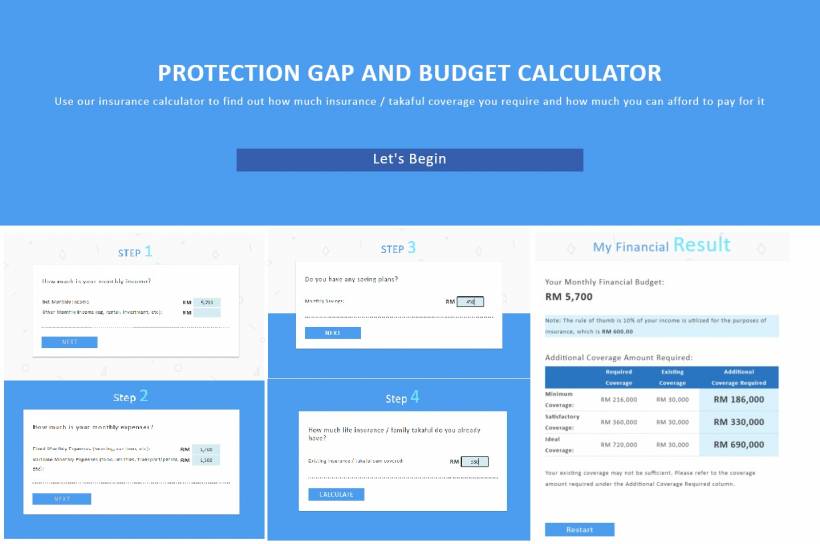

At its core, the calculator is more than just a digital form—it's an awareness platform. Users begin by entering a few key details: their income, expenses, savings, and existing insurance or takaful coverage. From there, the system processes the inputs and produces a comprehensive projection showing their current protection gap and the ideal coverage level they should target.

Instead of leaving users with vague results, it breaks everything down clearly—how much coverage is required, how much they already have, and the shortfall that needs to be addressed. This not only simplifies the math but also helps users understand why certain levels of protection are recommended.

Designed for Simplicity and Confidence

One of the main design principles was simplicity without sacrificing accuracy. The web interface walks users through each step:

By guiding users step by step, the calculator ensures the process feels approachable, even for those without a financial background. Every section is neatly organized, and each input field includes prompts to minimize confusion.

Once completed, users receive a visual and textual summary under "My Financial Result," showing their monthly financial budget and how much additional protection they may need—categorized as Minimum, Satisfactory, and Ideal Coverage.

From Numbers to Knowledge

The calculator isn't just about producing figures—it's about promoting understanding. By showing how financial variables interact, it teaches users the logic behind protection planning. Each result is accompanied by simple explanations that help people see how income, expenses, and insurance relate to their overall security.

This educational layer is what sets the system apart. It's not a black box spitting out numbers; it's a transparent guide that explains its reasoning. As a result, users walk away not just knowing their protection gap, but also why it exists and how to close it responsibly.

A Step Toward National Financial Literacy

This initiative was part of a broader national effort to promote financial literacy and protection awareness. By simplifying access to accurate calculations, the project supported Bank Negara Malaysia's push for greater insurance and takaful participation among Malaysians.

For many users, this was their first time seeing an accessible, non-commercial tool that offered genuine insights into their financial protection needs—without sales pressure. It became a trusted reference point for both individuals and industry players promoting responsible financial planning.

Educational, Transparent, and Responsible

Every feature of the calculator was intentionally crafted to serve a dual purpose:

By offering transparent breakdowns and a disclaimer highlighting that results are for guidance only, the tool strikes a balance between empowerment and responsibility. Users are encouraged to consult financial advisers or insurers before making any purchase decisions—reinforcing ethical financial behavior.

Technology That Serves People

From a technical standpoint, the calculator runs smoothly in any modern browser. It's lightweight, mobile-friendly, and optimized for accessibility. The interface uses clear call-to-action buttons like "Let's Begin," "Next," and "Calculate," making navigation seamless even for first-time visitors.

When the results appear, the structured layout—tables, color highlights, and easy-to-read typography—ensures that users can digest their information instantly. This thoughtful design reflects my ongoing focus on user experience and interface clarity across all Lemon Web Solutions applications.

Reinforcing ISM's Commitment to Innovation

This project also represented ISM's (Insurance Services Malaysia) broader mission to use technology as a force for public good. By offering this calculator as a free, web-based service, ISM underscored its role not just as a data provider, but as a driver of digital financial empowerment in Malaysia.

The Insurance Gap Protection Calculator became a benchmark for similar initiatives—showing how industry collaboration, guided by clear regulatory principles, can produce meaningful tools that directly benefit the public.

Why It Still Matters Today

Even years after its initial launch, the calculator's message remains highly relevant. In a world of rising costs, uncertain employment, and increasing financial complexity, understanding one's protection gap is crucial. Tools like this help individuals make informed, confident decisions about their insurance or takaful coverage—without intimidation or confusion.

Whether you're a young professional planning your first policy or a parent reviewing family coverage, the Insurance Gap Protection Calculator remains a timeless example of how technology can simplify financial planning and build national resilience.

Try It Yourself

You can access the calculator through Lemon Web Applications or directly by clicking on the button below. Take a few minutes to try it—you might be surprised how much insight you gain about your current protection level and the steps you can take to strengthen your financial safety net.

Disclaimer

The Insurance Gap Protection Calculator is intended for educational purposes only. The results are estimates based on general parameters and assumptions. For personalized financial advice or product recommendations, users should consult licensed financial advisers or insurance/takaful providers.