Artificial intelligence is everywhere — from ChatGPT answering your questions to companies promising AI will transform everything from healthcare to finance. But beneath the excitement lies a growing unease. Economists, investors, and even AI's most enthusiastic supporters are beginning to wonder: are we witnessing the rise of another tech bubble, one that could rival the dot-com crash of the late 1990s?

This article dives into what's fueling the trillion-dollar AI boom, why some experts are calling it unsustainable, and whether the signs point to a coming correction — or a long-term technological revolution.

The AI Gold Rush: Trillions Spent, But on What?

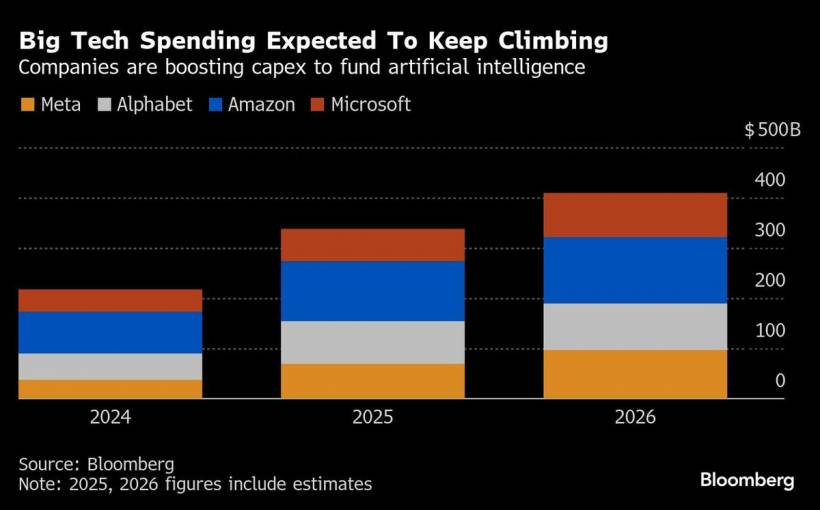

Since ChatGPT's explosion in popularity, the race to dominate AI has become a capital-intensive marathon. Tech giants like OpenAI, Meta, and Google are pouring hundreds of billions — and in some cases, trillions — into AI chips, data centers, and massive model training infrastructure.

These investments aren't just to power today's chatbots. They're meant to prepare for a future where much of the world's economic activity could shift from humans to machines.

But here's the catch: this technology, for all its potential, hasn't yet proven it can consistently make money. Many tech executives privately admit they're unsure how to turn AI into sustainable profit — yet they keep investing to avoid falling behind rivals.

Signs the Bubble Is Inflating

1. Unrealistic Spending and "Stargate" Ambitions

In January, OpenAI's CEO Sam Altman announced a US$500 billion project called Stargate, a grand vision to build the ultimate AI infrastructure. The sheer scale stunned analysts. Since then, Altman has hinted the total cost could hit "trillions."

Meta's Mark Zuckerberg quickly followed suit, pledging hundreds of billions for his own data center buildouts. The spending spree is staggering — and increasingly funded by debt. Meta borrowed US$26 billion to construct what it calls one of the world's largest data center complexes, while JPMorgan and MUFG recently led a US$22 billion loan for another mega facility.

2. Questionable Financing Deals

Chipmaker Nvidia — now the world's most valuable company — recently struck a US$100 billion deal with OpenAI to finance its data center expansion. Analysts warn this could blur lines between customer support and self-interest, as many of Nvidia's clients use such funding to buy… Nvidia chips.

3. Vanishing Returns

According to Bain & Co, AI companies will need to generate US$2 trillion in annual revenue by 2030 just to fund their computing needs — but they'll likely fall short by nearly US$800 billion. Even Altman admits OpenAI could burn through US$115 billion by 2029.

Cracks Beneath the Hype 1. Weak ROI Across Industries

A sobering MIT study found that 95% of organisations using AI saw no financial return. Many companies simply haven't figured out how to integrate AI meaningfully into their workflows.

2. The Rise of "Workslop"

Researchers from Harvard and Stanford coined the term workslop — AI-generated content that looks polished but offers little real value. Instead of boosting productivity, it's costing large firms millions in wasted output.

3. Diminishing Breakthroughs

For years, AI development followed the belief that more data + bigger models = smarter AI. But that trend is flattening. Even as OpenAI, Anthropic, and others build ever-larger systems, the leaps forward are getting smaller.

Altman himself recently admitted that "we're still missing something quite important" to achieve true artificial general intelligence (AGI).

The China Factor and Energy Constraints

China's tech firms are now releasing competitive, low-cost AI models that could undercut American players. This growing competition may squeeze margins further and make it even harder for U.S. firms to recoup their massive infrastructure investments.

At the same time, the global electricity demand of AI data centers is skyrocketing. National power grids — already under pressure — might not keep up with the industry's energy appetite.

The Voices of Optimism

Despite the warnings, AI leaders remain confident.

Sam Altman openly acknowledges we might be in a "frothy" phase, yet insists AI is the most important technology in decades. Mark Zuckerberg agrees, calling a potential AI bubble "quite possible," but warns that not investing enough could be an even bigger mistake.

Both believe that AI will soon become indispensable — a superintelligent assistant capable of managing everything from code to creative work. OpenAI's CFO Sarah Friar even suggested a US$2,000 monthly AI subscription might be justifiable "if it functions like a PhD-level personal assistant."

What Defines a Bubble?

In classic economic terms, a bubble happens when market prices soar far beyond their real-world value — followed by a sharp collapse. Economist Hyman Minsky identified five stages:

Displacement, Boom, Euphoria, Profit-Taking, and Panic.

The AI boom currently sits somewhere between Euphoria and Profit-Taking. Companies are making bold claims, valuations are sky-high, and investors are rushing in — not wanting to miss the next big thing.

The danger? When reality doesn't meet expectations, the panic phase begins.

Déjà Vu: Lessons from the Dot-Com Crash

The dot-com bubble of the late 1990s saw companies raise billions on the promise of "internet traffic" — not profits. Telecom giants built massive fibre networks for customers who never came. When the crash hit in 2001, thousands of startups vanished overnight.

Today's AI boom carries similar warning signs:

However, there are also differences. Unlike the dot-com era, the "Magnificent Seven" tech giants — Microsoft, Google, Apple, Amazon, Meta, Nvidia, and Tesla — are immensely profitable and can weather downturns. Plus, AI adoption is real: ChatGPT boasts over 700 million weekly users, and OpenAI's revenue is on track to triple in 2025.

Will the Bubble Burst?

Some experts believe the AI market will mirror the dot-com cycle — a painful correction followed by lasting innovation. Companies that can't monetise AI may vanish, but others, like Amazon and Google after 2001, could emerge stronger.

OpenAI chairman Bret Taylor sums it up best:

"It's both true that AI will transform the economy — and that we're in a bubble. A lot of people will lose a lot of money."

by Author

For now, the AI boom continues — powered by ambition, competition, and an almost religious belief that artificial intelligence will define the next century. Whether it ends in a crash or a lasting revolution will depend on one question: can AI actually pay for itself?

Comments