If you're a small business owner in Malaysia, there's good news on the e-invoicing front. The government has officially revised the implementation timeline for businesses with annual revenue under RM5 million — giving you more breathing room to get your systems in place.

Who's Affected by This Change?

The Inland Revenue Board (LHDN) announced today that businesses earning below RM5 million annually will now follow a newly revised timeline for mandatory e-invoicing implementation. This change is designed to give micro, small, and medium enterprises (MSMEs) more time to prepare and adapt.

New E-Invoicing Deadlines by Category

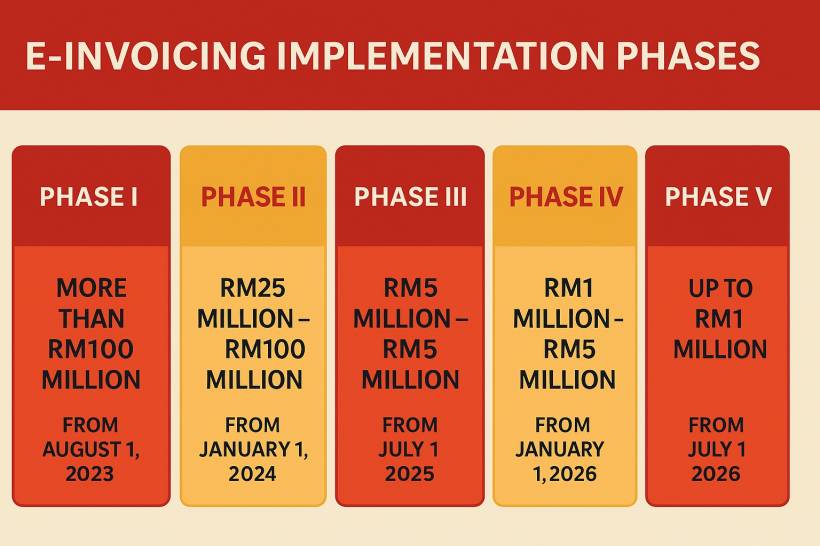

Here's how the rollout now looks:

Phase III

Phase IV

Phase V

And here's an additional relief:

Why the Delay?

LHDN acknowledged that many MSMEs face operational and technical challenges when adapting to e-invoicing. They also recognize that businesses need adequate time to make the transition. Rather than rushing compliance, the government is opting for a phased approach to avoid disruptions — a move welcomed by many business groups.

What About Compliance During the Grace Period?

Businesses that fall under the later phases won't face legal action during the grace period — as long as they meet basic requirements. Specifically:

A Win for MSMEs?

Earlier this year, the Small and Medium Enterprises Association of Malaysia (SAMENTA) urged the government to raise the exemption threshold to RM300,000, arguing that too many small businesses were struggling with the current requirements. While the current exemption remains at RM500,000, this phased delay shows that the government is listening — at least in part.

Quick Recap of the Phases

Here's a brief refresher on how e-invoicing was originally introduced:

Final Thoughts

The move to e-invoicing is inevitable — and eventually beneficial — but for smaller businesses, the extra time is a much-needed buffer. Use this grace period wisely to upgrade your systems, seek training, and ensure compliance by the new deadlines.

Still unsure how this applies to your business? Now's a good time to talk to your accountant or tax advisor.

Comments